Fintech

Fine grained authorization for fintech

In fintech, every click moves real money. If you can’t prove who did what, when, and why, you’re exposed to fraud, insider abuse, and regulatory penalties.

Trusted by fintech teams building with security in mind

Streamline compliance

Meet audit requirements with centralized authorization logs.

Reduce development costs

Cut time spent building & maintaining authorization.

Update authorization instantly

Roll out new roles, limits, and financial controls.

Authorization for financial systems

Production ready authorization for your team

Banking

Consistent, safe access for accounts and payments.

Payments

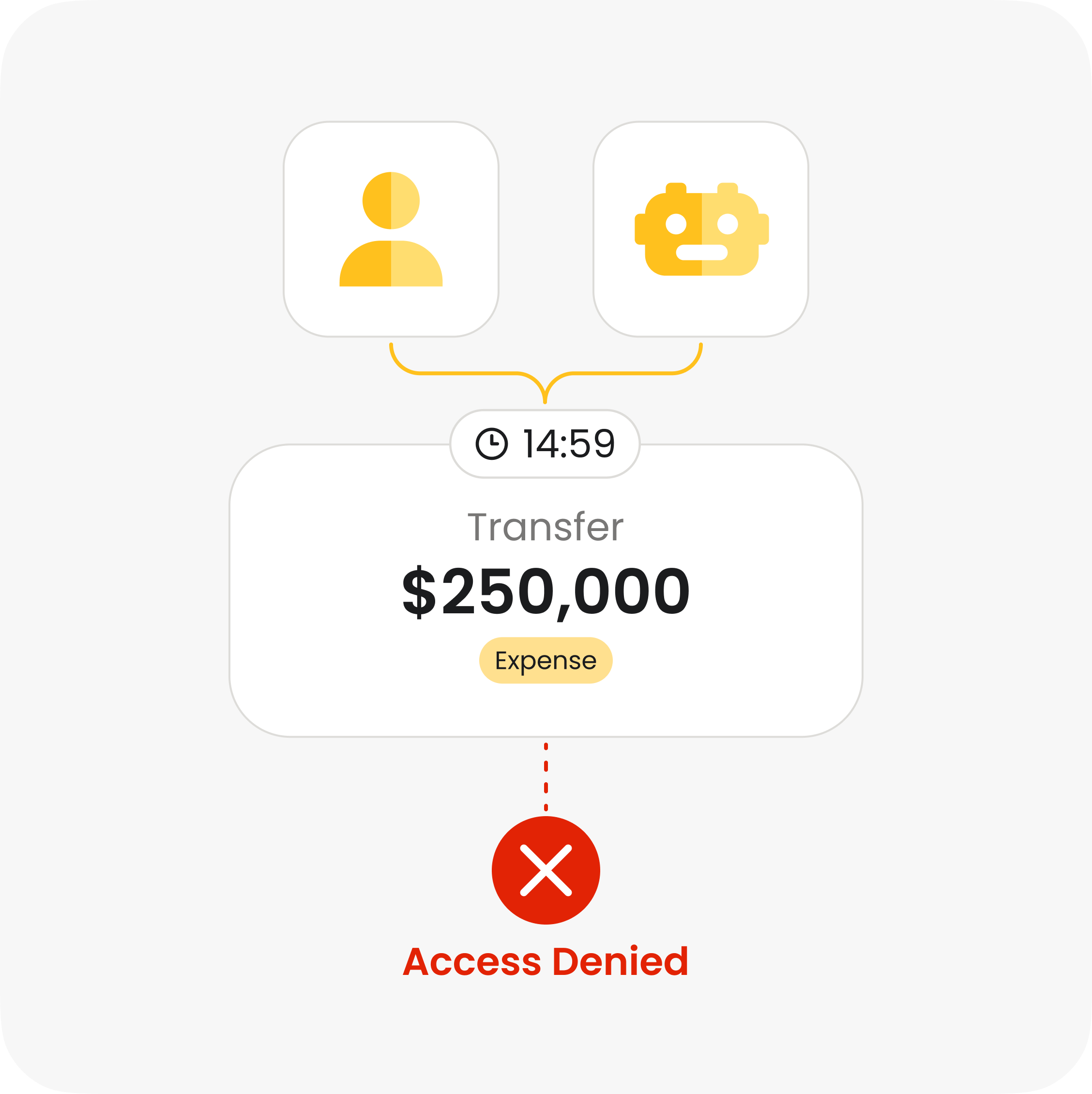

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Banking

Consistent, safe access for accounts and payments.

Payments

Control which agents can trigger transactions.

Lending and credit

Clear, explainable rules for approvals.

AI-driven finance

Limit agents to safe, auditable actions.

Core banking

Unified policy logic across services.

Wealth and trading

Restrict access to portfolios and trades.

BaaS

Isolated, per-client authorization control.

Regulated enviroment

Run on-prem, air-gapped, hybrid with full auditability.

Why access control can’t be ignored

Security blind spot

Every transfer, approval, and data request depends on authorization logic.

Uncontrolled money movement

Over-permissive roles or missing real-time policy checks allow payment services to execute transfers.

Over broad data access

AI agents, APIs, and backend services often have broad access to customer PI & transaction data.

Untraceable access changes

When access rules are managed in different systems, no one can clearly see who changed permissions.

Slow compliance response

Every new AML or KYC rule requires code-level permission updates, delaying rollout and increasing audit risk.

Real breaches. Real companies. Real consequences.

90K accounts exposed

A broken session isolation bug caused users to see other users' account data, exposing PI and payment info due to failed authorization checks between sessions.

7M records leaked

An attacker abused overly broad internal support tool permissions, accessing sensitive user data without proper role-based access enforcement.

Zero Trust security at scale

Protect every financial action with Cerbos

Enforce fine grained, contextual, and continuous authorization across your financial systems. Protect payments, accounts, and AI-driven actions with strong access control.

1

Define access rules

Set clear, explainable policies for transfers, approvals, credit actions, sensitive data access, and AI-initiated operations — all outside your application code.

Set clear, explainable policies for transfers, approvals, credit actions, sensitive data access, and AI-initiated operations — all outside your application code.

2

Deploy Cerbos across your services

Run Cerbos PDP next to your core systems, payment processors, trading engines, decisioning services, or AI agents to enforce real-time, consistent authorization.

Run Cerbos PDP next to your core systems, payment processors, trading engines, decisioning services, or AI agents to enforce real-time, consistent authorization.

3

Integrate checks into money flows

Every transfer, trade, portfolio action, loan request, or AI-initiated event is evaluated against your policies before it’s allowed.

Every transfer, trade, portfolio action, loan request, or AI-initiated event is evaluated against your policies before it’s allowed.

4

Monitor and audit every decision

Get full visibility into who accessed what, which agent triggered which action, and why a financial decision was approved or denied.

Get full visibility into who accessed what, which agent triggered which action, and why a financial decision was approved or denied.

Compliance ready with every authorization decision

SOC 2

SOC 3

HIPAA

GDPR

ISO 27001

FedRAMP

PCI DSS

SOC 2

SOC 3

HIPAA

GDPR

ISO 27001

FedRAMP

PCI DSS

Capture every decision for all identities

Log requests, actions, resources, access outcomes, and service-to-service authorization calls for both humans and machines.

Trace policy lineage

See the exact policy, version, and release behind each decision for complete traceability and post-incident review.

Monitor with context

Review detailed logs, policy versions, and real-time metrics across all PDPs and environments.

Simplify audits and compliance

Maintain centralized, structured logs to support audits and demonstrate readiness for FedRAMP, SOC 2&3, ISO 27001, HIPAA, PCI DSS, and GDPR.

Fits into your IAM infrastructure

Connect with your stack, at an instance

How teams benefit from Cerbos for secure authorization

“We got the foundation set. Now we can scale and include more complex policies. And we can grow in the right direction and with the right security.”

Edgar Rivera

CEO @4gcapital

Saved per year by switching authorization services.

Policies are updated in minutes when requirements change.

How fintech teams use Cerbos

Saved $264k per year with scalable authorization

$264k saved per year vs. in-house build.

Policies are updated in minutes when requirements change.

Audit-ready compliance for ISO27001, SOC2, GDPR, PSD2, CCPA.

Modified product packaging in 10 minutes

Reduced hours of developer time to 10 minutes.

Eliminated technical debt from authorization.

Accelerated feature development and time to market.

Onboarded 3x more users with granular roles and permissions

Increased number of user roles available in the product.

Increased customer adoption with better user experience.

Secure and reliable access gating for sensitive resources.

Learn how to design authorization for financial systems

Article

Mapping business requirements to authorization policy for fintech

Webinar

Mastering authorization in Fintech

Guide

Designing an authorization model for an enterprise

Article

How Cerbos helped Nook build secure and extensible roles and permissions

Ebook

Building a scalable authorization system: a step-by-step blueprint

Ebook

How to adopt externalized authorization

Cerbos brings consistent authorization to your financial stack

Ensure every payment, account action, and AI-initiated operation is governed by fine grained, contextual authorization.

Authorization for AI systems

By industry

By business requirement

Useful links

What is Cerbos?

Cerbos is an end-to-end enterprise authorization software for Zero Trust environments and AI-powered systems. It enforces fine-grained, contextual, and continuous authorization across apps, APIs, AI agents, MCP servers, services, and workloads.

Cerbos consists of an open-source Policy Decision Point, Enforcement Point integrations, and a centrally managed Policy Administration Plane (Cerbos Hub) that coordinates unified policy-based authorization across your architecture. Enforce least privilege & maintain full visibility into access decisions with Cerbos authorization.