Insurance

Authorization for regulated insurance systems

Control who can approve claims, change policies, and access sensitive customer and health data with fine grained authorization.

Trusted by fintech teams building with security in mind

Developer time savings

Reduce time spent implementing and updating authorization.

Flexible access rules

Adjust claim and policy access rules without code changes.

Audit ready access

Support regulatory reviews with auditable access decisions.

Authorization for insurance systems

Production ready authorization for your team

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Claims handling

Rules for claim intake, review, and approval.

Underwriting decisions

Control changes to risk factors and premiums.

Policy servicing

Secure updates to coverage and beneficiaries.

Fraud investigation

Restrict access to suspicious cases and evidence.

Agent and broker network

Granular access for agents, brokers and adjusters.

Customer data protection

Controlled access to PII, health data, policy records.

Payments and disbursements

Boundaries for payouts and reimbursement actions.

AI-driven automation

Safe agent actions for quotes, claims, and servicing workflows.

Why access control can’t be ignored

Authorization blind spots

Every claim update, policy change, and payout decision depends on authorization logic.

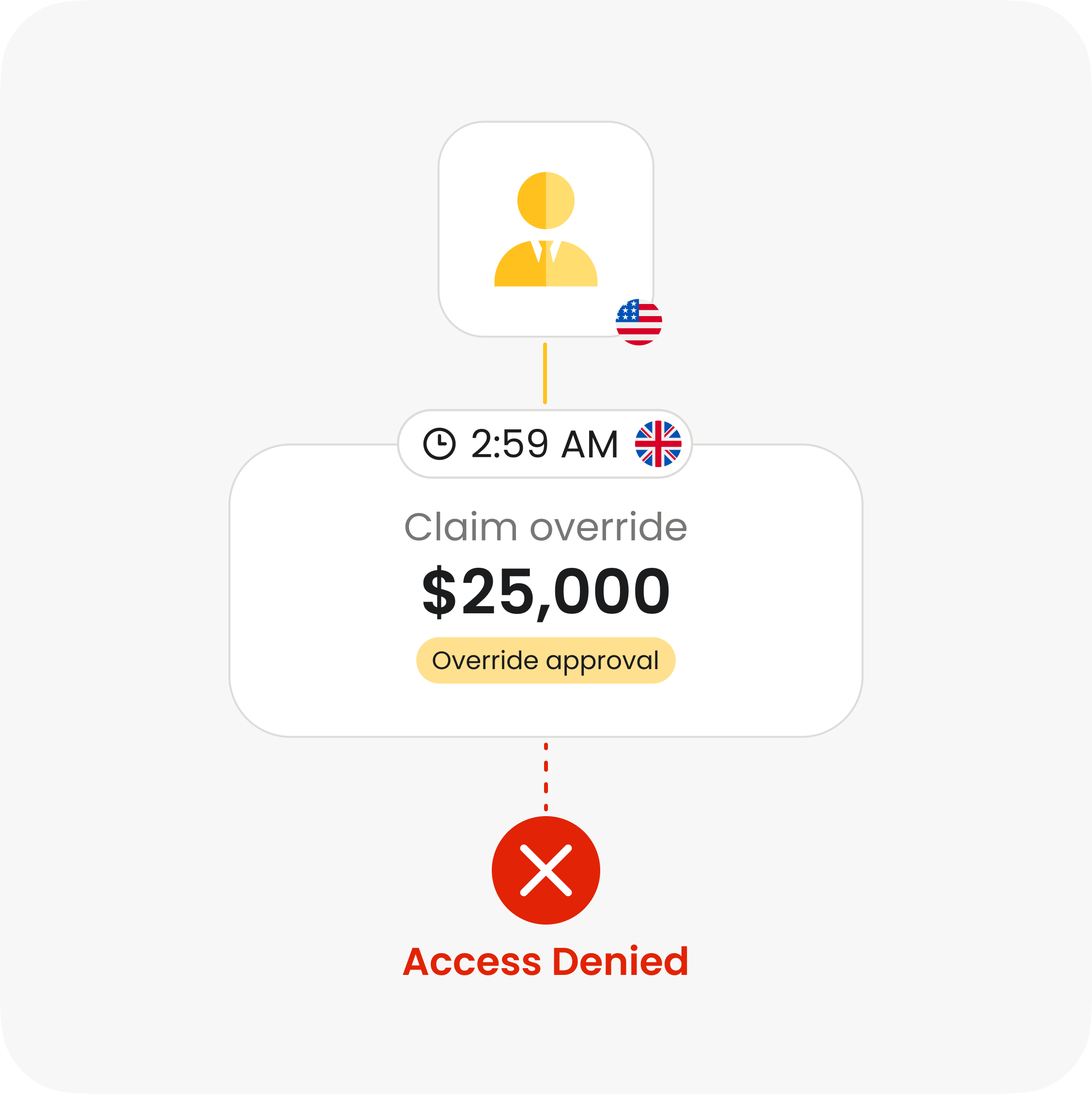

Unauthorized claim actions

Over permissive roles allow agents and claims systems to approve or override claims.

Sensitive data exposure

Customer and health data are often accessible beyond intended roles.

Untraceable access changes

Permission updates lack clear ownership and audit trails.

Delayed compliance controls

New rules take too long to enforce when access logic lives in code.

Real breaches. Real companies. Real consequences.

825K+ records leaked

APIs exposed personal data through public quote tools with no access checks.

— 8+ US auto insurers, 2020–2021

56.4M records at risk

APIs lacked object-level authorization, exposing full customer profiles.

— Policybazaar, 2022

Zero Trust security at scale

Fine grained authorization for insurance with Cerbos

Enterprise grade authorization for insurance systems, providing consistent allow or deny decisions for claims, policy changes, and payouts.

1

Define authorization policies

Model fine grained authorization for claims, policies, payouts, and sensitive data outside application code.

Model fine grained authorization for claims, policies, payouts, and sensitive data outside application code.

2

Deploy Cerbos PDPs

Run Cerbos next to insurance services to enforce consistent, real time authorization.

Run Cerbos next to insurance services to enforce consistent, real time authorization.

3

Enforce decisions everywhere

Evaluate every claim, policy, and payout action against authorization policies.

Evaluate every claim, policy, and payout action against authorization policies.

4

Audit every decision

Record who did what, why it was allowed, and which policy enforced it.

Record who did what, why it was allowed, and which policy enforced it.

Compliance-ready with every authorization decision

SOC 2

SOC 3

HIPAA

GDPR

ISO 27001

FedRAMP

PCI DSS

SOC 2

SOC 3

HIPAA

GDPR

ISO 27001

FedRAMP

PCI DSS

Capture every decision for all identities

Log access decisions for claim actions, policy updates, agent access, service-to-service calls across humans and machines.

Trace policy lineage

See the exact policy, version, and release behind each decision for complete traceability and post-incident review.

Monitor with context

Review detailed logs, policy versions, and real-time metrics across all PDPs and environments.

Simplify audits and compliance

Maintain centralized, structured logs to support audits and demonstrate readiness for FedRAMP, SOC 2&3, ISO 27001, HIPAA, PCI DSS, and GDPR.

Fits into your IAM infrastructure

Connect with your stack, at an instance

How teams benefit from Cerbos for secure authorization

“We got the foundation set. Now we can scale and include more complex policies. And we can grow in the right direction and with the right security.”

Edgar Rivera

CEO @4gcapital

Saved per year by switching authorization services.

Policies are updated in minutes when requirements change.

Learn more about policy management

Article

Mapping business requirements to authorization policy for fintech

Guide

Designing an authorization model for an enterprise

Ebook

Building a scalable authorization system: a step-by-step blueprint

Ebook

How to adopt externalized authorization

Protect critical insurance workflows with Cerbos

Enforce consistent access control across claims processing, policy changes, payouts, and sensitive customer data.

Authorization for AI systems

By industry

By business requirement

Useful links

What is Cerbos?

Cerbos is an end-to-end enterprise authorization software for Zero Trust environments and AI-powered systems. It enforces fine-grained, contextual, and continuous authorization across apps, APIs, AI agents, MCP servers, services, and workloads.

Cerbos consists of an open-source Policy Decision Point, Enforcement Point integrations, and a centrally managed Policy Administration Plane (Cerbos Hub) that coordinates unified policy-based authorization across your architecture. Enforce least privilege & maintain full visibility into access decisions with Cerbos authorization.