10 fintech security tools to build a compliant and resilient security stack

In my previous guide, I focused on where fintech security architectures break and what structural controls are required. This section moves from principles to tooling.

Fintech systems handle payments, balances, KYC records, and payout flows. They run under regulatory constraints, external audits, and persistent sector level threat pressure. ENISA’s Threat Landscape 2024 identifies finance as one of the most targeted sectors in reported cybersecurity incidents!

So security cannot be implemented as an isolated feature. It is a set of enforced controls across identity, access, transaction validation, encryption, infrastructure boundaries, and audit logging.

I picked a few security tools to show how those controls can be implemented in fintech. You might want to see more vendors to choose from. I’m open to adding more security tools that are useful for fintech products. Feel free to send me a DM on LinkedIn.

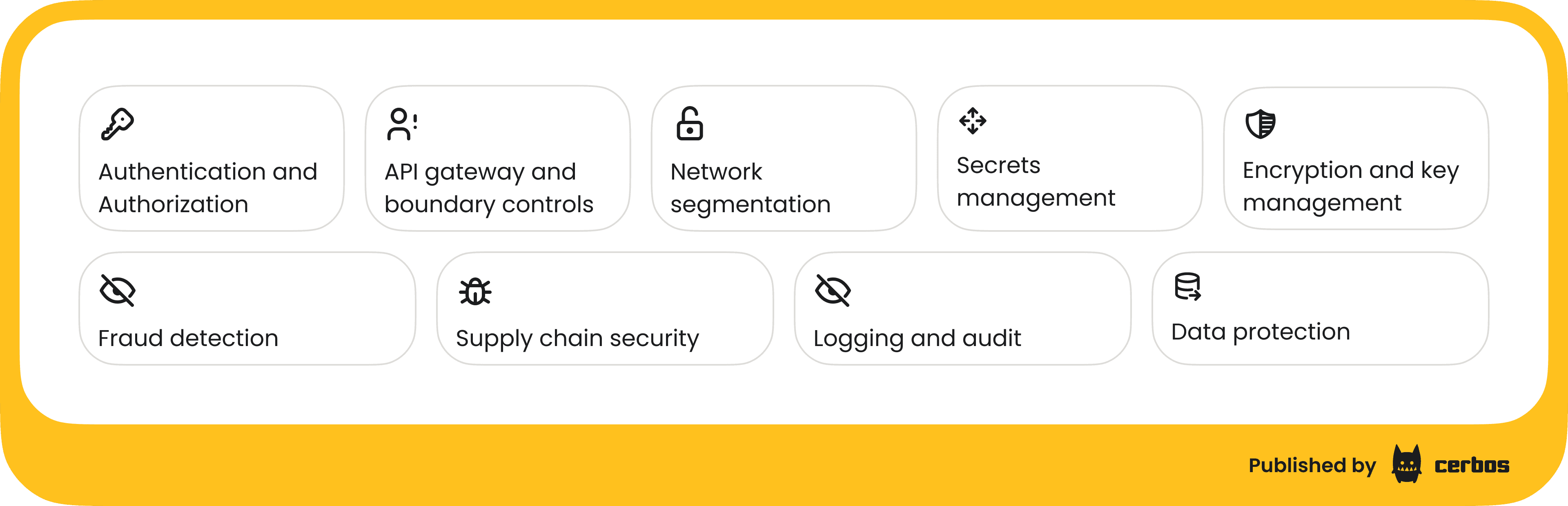

What tools do you need?

This is an architectural decision. It should be aligned with your VP of Engineering and CISO. Tooling follows control requirements, not the other way around. There are security areas you cannot avoid in a regulated fintech system:

1. Cerbos – Runtime authorization for financial systems

Fintech products depend on policy driven authorization at every decision point. Every payment, account update, approval, and AI initiated action must be evaluated against defined access policies. This aligns with control expectations in standards such as PCI DSS and ISO 27001, which require authorization checks before sensitive actions.

When authorization is fragmented or hard coded across services, policy evaluation becomes inconsistent and difficult to trace. You lose a single source of truth for who can access what and why in your product.

Cerbos is an authorization management platform, that provides a centralized control plane for managing, testing, deploying, and enforcing access control across distributed systems. Identity systems establish who someone or something is. Cerbos determines what they are allowed to do at the moment a decision is enforced, across APIs, services, AI agents, and data.

This approach reduces hidden access risk, enforces least privilege for humans and non-human identities, and keeps authorization logic consistent as fintech platforms scale across products, regions, and regulatory environments.

With Cerbos, every access decision is traceable back to versioned policy logic, supporting SOC 2, ISO 27001, PCI DSS, and internal audit requirements

Key capabilities:

- Fine-grained, contextual authorization

- Support for RBAC, ABAC, ReBAC, and PBAC models

- Runtime, event-time, and admin-time access policy evaluation

- Stateless by design, CI/CD ready

- Authorization for AI agents, MCP-based systems, and RAG pipelines

- Supports evidence collection for fintech compliance and internal audit

- Cloud, self-hosted, on-premise, and air-gapped deployment options

2. Okta – Identity and authentication for financial platforms

IBM’s X Force Threat Intelligence Index 2024 reports that the use of stolen credentials surged 71% over the previous year. Credential theft and phishing frequently target users with access to payouts, limit adjustments, and internal dashboards.

No fintech product ships without authentication. The question is how you implement it and how well it holds up under real transaction risk.

Okta is an identity platform that manages authentication and the user lifecycle. It handles login flows, enforces multi-factor authentication, and issues tokens using OAuth 2.0 and OpenID Connect. High-risk operations such as withdrawals or payout approvals can require step-up authentication based on defined policies and risk signals.

If you are building customer-facing login flows or a B2C fintech product, Auth0 may be a better fit. And if you are evaluating other identity providers, you can review our Auth0 alternatives comparison here.

Key capabilities:

- Phishing-resistant multi-factor authentication using FIDO2 and WebAuthn

- OAuth 2.0 and OpenID Connect support for token-based authentication and identity claims

- Risk-based authentication policies

- User provisioning, deprovisioning, and directory integration

- Device trust and session management controls for web and mobile banking applications

- Bot detection and credential stuffing mitigation integrations

3. HashiCorp Vault – Secrets and key management for payment systems

When you send money in an app like Revolut or pay through Stripe, a single transaction triggers multiple internal service calls. Each request between services is authenticated using API keys, database credentials, mTLS certificates, or other cryptographic material.

HashiCorp Vault centralizes how those secrets and cryptographic keys are stored, issued, and revoked. Instead of embedding long-lived keys in configuration files or application code, services request short-lived credentials with a defined scope. Vault also manages encryption keys used to protect sensitive financial and identity data across environments. So this is a must-have security tool for fintech.

Key capabilities:

- Dynamic credentials for databases and service integrations

- Automated rotation of API keys and cryptographic material

- Encryption key management for data at rest and in transit

- Audit logging for secret access and key usage

4. Stripe Radar – Fraud detection in fintech

Every payment request carries context: amount, device fingerprint, IP address, account history, and behavioral signals. Radar evaluates these attributes at the time the transaction is submitted and assigns a risk score before the charge or payout is finalized.

Radar operates directly within Stripe’s payment flow. It applies rule-based logic and machine learning models to detect patterns such as abnormal transaction velocity, card testing, or anomalous account behavior. You can define custom rules to block, review, or allow transactions based on risk thresholds.

Key capabilities:

- Real-time risk scoring within Stripe payment flows

- Velocity checks and anomaly detection across transactions

- Machine learning–based fraud models

- Custom rule engine for transaction blocking or review

- Risk signal evaluation before charge or payout execution

5. Snyk – Supply chain security for fintech applications

Payment services and customer-facing applications include third-party dependencies pulled through package managers. SDKs for payments, analytics, logging, and encryption libraries are introduced through dependency manifests and updated over time.

Snyk scans dependency manifests and container images to identify known vulnerabilities in direct and transitive packages. It integrates with source control and CI so findings surface during pull requests and builds. You can configure Snyk to enforce vulnerability thresholds in your CI pipeline. Builds are blocked when newly introduced dependencies contain issues above a defined severity level, preventing those components from being deployed into services that handle transactions or sensitive account data.

Key capabilities:

- Dependency and container image vulnerability scanning

- Detection of transitive vulnerabilities across package trees

- CI and pull request integration for build-time enforcement

- Continuous monitoring for newly disclosed CVEs

- Policy controls for severity thresholds and remediation tracking

6. Kong – API gateway for open banking and partner integrations

Open banking integrations access your platform through publicly exposed HTTPS endpoints. Third-party systems call defined routes that map to upstream services inside your environment.

Kong runs as a reverse proxy in front of those services. It defines Services, Routes, and Consumers, and processes inbound traffic through a configurable plugin chain. Authentication, token validation, rate limiting, and request checks are applied before traffic is forwarded upstream.

Configuration can be managed declaratively or through an admin interface. In hybrid deployments, a control plane distributes configuration to data plane nodes that handle live traffic.

Kong does not implement business logic. It applies HTTP-level controls and then proxies validated requests to backend systems.

Key capabilities:

- Token validation and authentication plugins

- Rate limiting and quota enforcement for financial APIs

- Request schema validation for payment endpoints

- Webhook signature verification for third-party callbacks

- Integration with backend authorization services

7. Palo Alto Networks NGFW – Network segmentation for regulated environments

Network segmentation defines how traffic moves between external interfaces, application tiers, and data stores. In financial systems, payment processing components and cardholder data environments are typically isolated from public-facing services through defined network zones.

Actually, PCI DSS v4.0.1 requires segmentation controls to limit the scope of the cardholder data environment and reduce exposure of payment systems.

Palo Alto Networks NGFW enforces traffic control between those zones. It performs Layer 7 inspection and classifies applications independently of port or protocol. Security rules can reference application identity, user identity, and network zone.

The platform includes intrusion prevention and threat detection engines that inspect traffic for known exploit patterns. SSL/TLS decryption allows encrypted traffic to be inspected before it is forwarded to internal systems.

Key capabilities:

- Application-level traffic classification and control

- Layer 7 deep packet inspection

- Intrusion prevention and threat detection

- Zone-based network segmentation

- SSL/TLS decryption for traffic inspection

8. Splunk – Security analytics for financial traceability

A payment attempt, a failed login, or a manual account adjustment generates multiple events across your platform. Application logs, API gateways, identity systems, and infrastructure components each record part of that activity.

Splunk collects those logs into a centralized indexing pipeline. Data from different sources is parsed and stored with searchable fields. You can run queries that correlate authentication events, API calls, and transaction records tied to the same account or session.

Alerts and dashboards are built on top of indexed data. Detection rules trigger when defined patterns appear across event streams. Historical searches support the investigation of transaction disputes or administrative changes across systems. This is very useful for fintech compliance.

Key capabilities:

- Centralized log ingestion and indexing

- Cross-source event correlation using search queries

- Real-time alerting based on defined detection rules

- Dashboarding and visualization of operational events

- Long-term event retention and search across indexed data

9. Google Cloud DLP – Data protection for KYC and payment data

Let’s talk about data protection. KYC documents, card numbers, and transaction records are stored across databases, object storage, and analytics systems. Those datasets often contain regulated identifiers that must be identified before they are processed, shared, or exported.

Google Cloud DLP inspects structured and unstructured data across supported Google Cloud services. It uses predefined and custom infoTypes to detect elements such as payment card numbers, government identifiers, and other sensitive financial fields. Inspection results include metadata that identifies the matched data type and its location.

Detected values can be transformed using masking, tokenization, or de-identification APIs. DLP jobs can run against stored datasets or inspect data in motion before it is written to storage or passed to downstream systems.

Key capabilities:

- Predefined and custom infoType detection

- Inspection of Cloud Storage, BigQuery, and Datastore

- Structured and unstructured data scanning

- Data masking, tokenization, and de-identification APIs

- Batch and streaming inspection jobs

10. AWS KMS – Encryption and key control for financial data

Encryption protects financial records even if identity or network controls fail. In a system that stores account balances, transaction histories, or identity documents, data at rest must remain unreadable without the correct cryptographic keys.

AWS KMS provides managed cryptographic keys that applications use through API calls. Services request data keys for envelope encryption. The data is encrypted locally, and the data key is stored only in encrypted form under a KMS-managed key.

Access to encrypt and decrypt operations is controlled through IAM policies and key policies attached to each KMS key. Key material can be rotated automatically for supported key types. All key usage events are recorded in CloudTrail (it’s AWS’s API activity logging service), creating a traceable record of cryptographic operations.

Key capabilities:

- Regional key management with hardware-backed protection

- Envelope encryption support for application data

- Automatic rotation for managed symmetric keys

- CloudTrail logging of key usage events

Thanks for reading. I hope your fintech security stack will become even stronger 🔐. And if you want to learn more about securing fintech systems when AI enters production, watch our pre recorded webinar on applying authorization, least privilege, and runtime controls to AI driven financial workflows.

FAQ

Book a free Policy Workshop to discuss your requirements and get your first policy written by the Cerbos team

Recommended content

Mapping business requirements to authorization policy

eBook: Zero Trust for AI, securing MCP servers

Experiment, learn, and prototype with Cerbos Playground

eBook: How to adopt externalized authorization

Framework for evaluating authorization providers and solutions

Staying compliant – What you need to know

Subscribe to our newsletter

Join thousands of developers | Features and updates | 1x per month | No spam, just goodies.

Authorization for AI systems

By industry

By business requirement

Useful links

What is Cerbos?

Cerbos is an end-to-end enterprise authorization software for Zero Trust environments and AI-powered systems. It enforces fine-grained, contextual, and continuous authorization across apps, APIs, AI agents, MCP servers, services, and workloads.

Cerbos consists of an open-source Policy Decision Point, Enforcement Point integrations, and a centrally managed Policy Administration Plane (Cerbos Hub) that coordinates unified policy-based authorization across your architecture. Enforce least privilege & maintain full visibility into access decisions with Cerbos authorization.